The 5-Minute Rule for Financial Advisor

Wiki Article

Everything about Advisor Financial Services

Table of ContentsThe Basic Principles Of Financial Advisor Fees Financial Advisor Definition Fundamentals ExplainedAbout Financial Advisor DefinitionGetting The Financial Advisor Meaning To Work

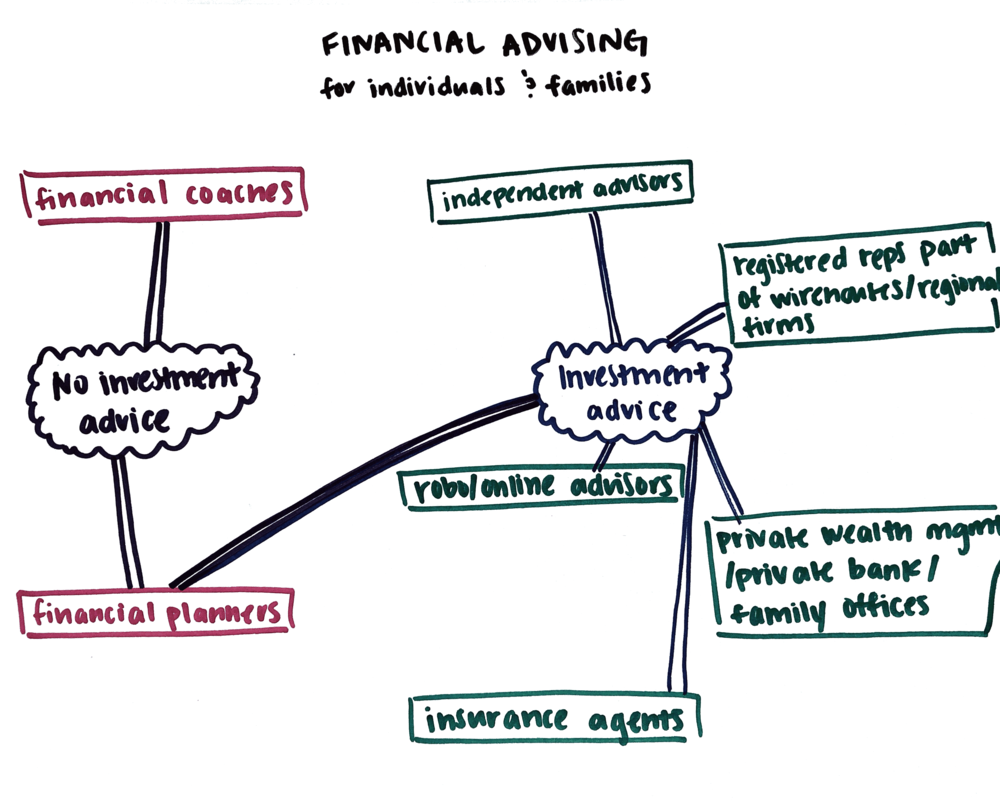

There are several kinds of financial advisors out there, each with varying qualifications, specializeds, as well as levels of responsibility. And also when you're on the search for an expert fit to your needs, it's not unusual to ask, "Exactly how do I understand which monetary advisor is best for me?" The answer starts with a truthful audit of your requirements and also a little of study.That's why it's necessary to study possible advisors and also comprehend their credentials prior to you hand over your cash. Sorts Of Financial Advisors to Take Into Consideration Depending upon your financial requirements, you might choose for a generalized or specialized financial expert. Recognizing your choices is the primary step. As you start to study the globe of choosing an economic advisor that fits your requirements, you will likely be presented with several titles leaving you wondering if you are contacting the appropriate individual.

It is crucial to keep in mind that some monetary consultants also have broker licenses (meaning they can market protections), however they are not only brokers. On the very same note, brokers are not all accredited similarly and are not monetary experts. This is just among the lots of reasons it is best to start with a certified economic coordinator who can encourage you on your investments as well as retirement.

5 Simple Techniques For Advisor Financial Services

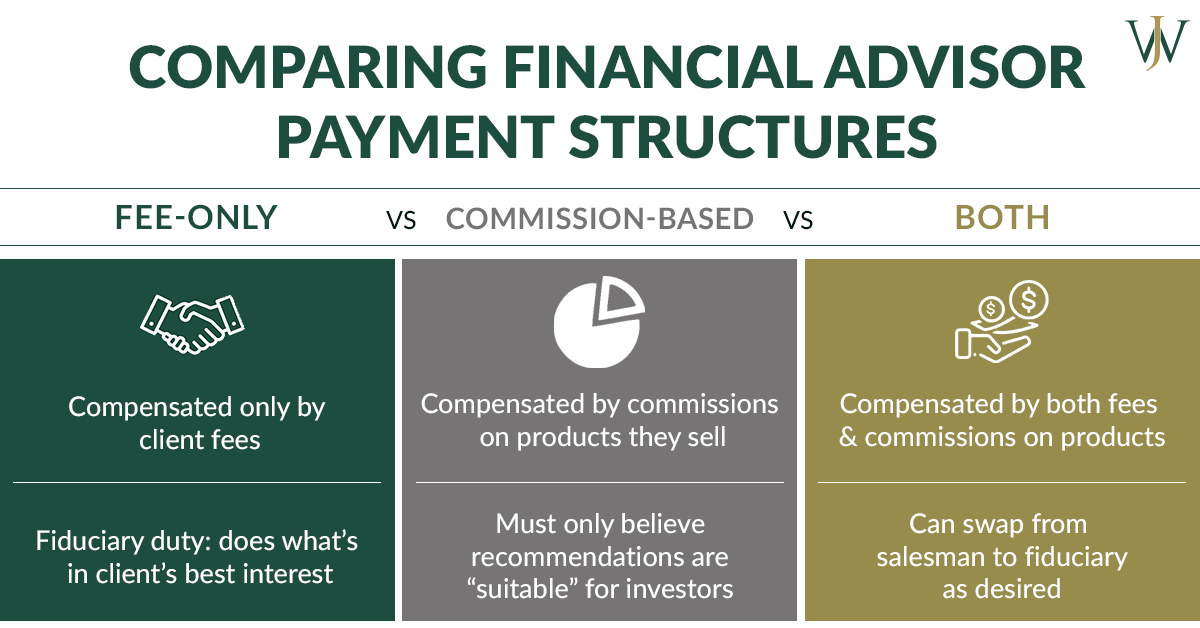

Unlike financial investment experts, brokers are not paid directly by customers, instead, they gain commissions for trading supplies as well as bonds, and for selling common funds as well as other items.

You can normally inform an advisor's specialty from his/her click here for more economic qualifications. As an example, an accredited estate planner (AEP) is an expert who focuses on estate preparation. When you're looking for a financial advisor, it's nice to have an idea what you desire assistance with. It's also worth discussing monetary coordinators. financial advisor certifications.

Much like "financial expert," "monetary coordinator" is likewise a broad term. Regardless of your certain demands and economic situation, one standards you should highly take into consideration is whether a prospective advisor is a fiduciary.

The 9-Second Trick For Financial Advisor Job Description

To secure yourself from a person that is simply trying to obtain more money from you, it's an excellent suggestion to search for an advisor that is signed up as a fiduciary. A monetary consultant who is registered as a fiduciary is needed, by law, to act in the most effective passions of a client.Fiduciaries can only suggest you to use such products if they think it's in fact the most effective financial decision for you to do so. The U.S. Stocks and Exchange Commission (SEC) manages fiduciaries. Fiduciaries that fall short to act in a customer's financial advisor bdo benefits might be struck with penalties and/or imprisonment of up to one decade.

That isn't since any individual can get them. Getting either accreditation needs somebody to go with a range of courses and also tests, in addition to making a set amount of hands-on experience. The result of the certification process is that CFPs and also Ch, FCs are fluent in topics across the area of personal money.

The fee can be 1. 5% for AUM in between $0 and also $1 million, however 1% for all properties over $1 million. Costs usually decrease as AUM boosts. An expert that earns money only from this monitoring fee is a fee-only expert. The option is a fee-based advisor. They appear comparable, yet there's an essential difference.

5 Easy Facts About Financial Advisor License Described

An expert's administration charge might or might not cover the costs linked with trading protections. Some consultants also charge an established charge per transaction.

This is a service where the consultant will certainly bundle all account administration expenses, including trading costs and also expense ratios, into one detailed fee. Because this cost covers more, it is normally higher than a charge that just includes monitoring and omits things like trading expenses. Wrap costs are appealing for their simpleness however additionally aren't worth the price for everybody.

While a conventional expert typically bills a charge in between 1% and 2% of AUM, the charge for a robo-advisor is usually 0. The large compromise with a robo-advisor is that you frequently don't have the ability to speak with a human advisor.

Report this wiki page